-

Automation is coming for our jobs once again

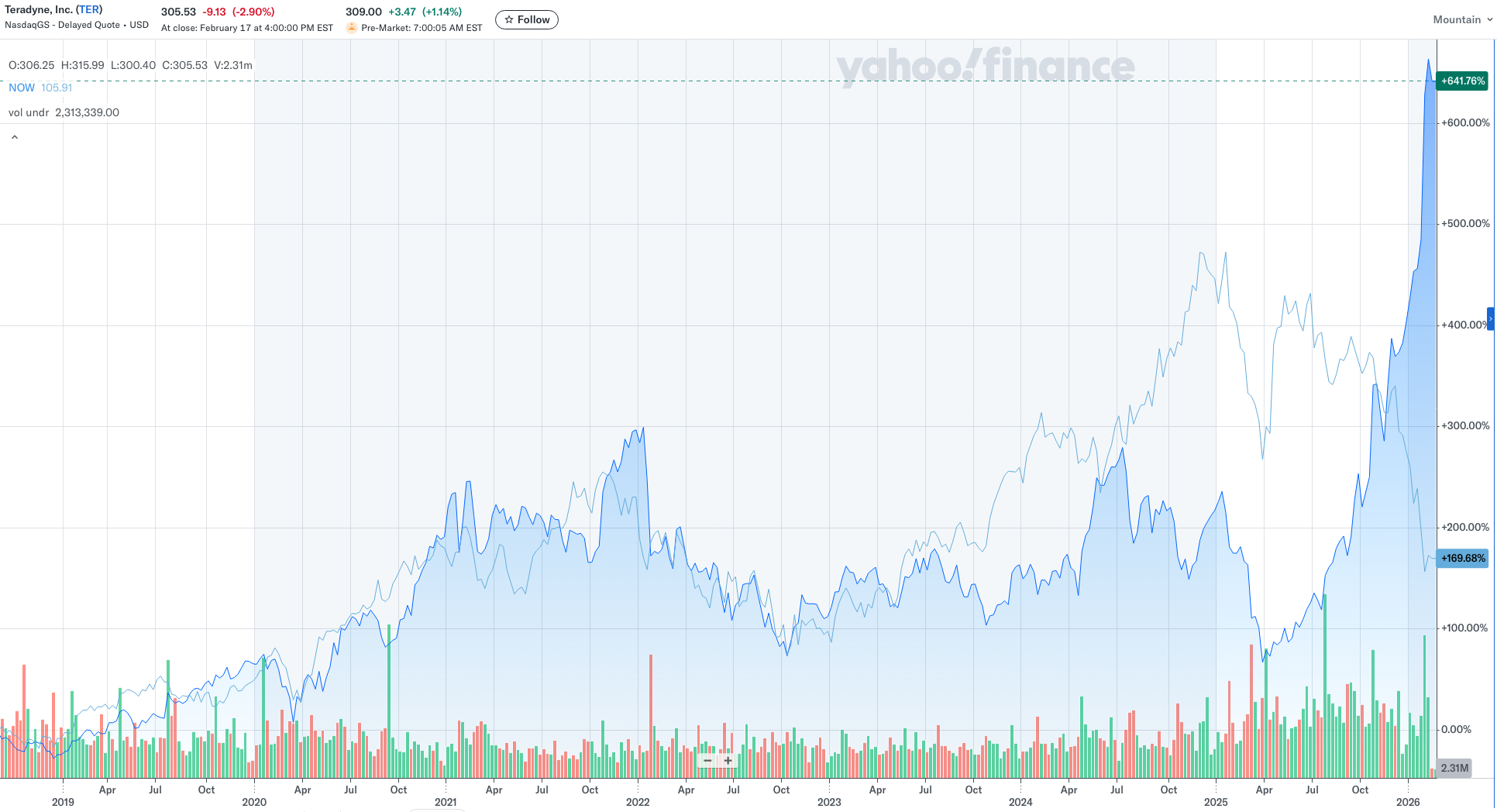

If you were to simply look at a chart that compares the price movement of Teradyne vs ServiceNow you could probably reverse-engineer the latest narrative to emerge and even pinpoint when it really caught hold.

These two charts were highly correlated for years until at first a narrative emerged in late 2024 that SaaS would be a major beneficiary by integrating automation and agents into their products, which propelled NOW way ahead of TER.

But then a rethink occurred in mid-2025 where the market began to question whether traditional SaaS would in fact benefit or just be destroyed entirely. Meanwhile, robotics and automation stocks like TER began to go vertical as the extension of the idea that traditional software would die was that automation and robotics would take over.

If we were to speculate that that narrative has reached a fever pitch with a combination of fear and excitement, we could then try and predict what happens next for this trade.

While I’m not sure I love diving back into software stocks, they do seem to be trying to form a base and I do think perhaps I’m reading fewer people trying to aggressively buy dips. I’m also starting to hear more people suggest SaaS will in fact be disrupted. All signs of possible capitulation on software. I do think this latest narrative has created a lot of confusion for SaaS vendors so their strategies going forward are a huge question mark and I believe will mark a turning point for the industry. As they say, “chaos is a ladder.”

However I think the bet against automation consuming everything is a good one at least in the short term. I believe a sort of mini bubble may have emerged here where the narrative has vastly outpaced the fundamentals and I’m not sure how much further that narrative can be extrapolated without some evidence of its truth.

I also think a rethink of that will have much larger implications than just TER stock and will come for semiconductors as well.

Once again the crowd has shown its ability to draw real world narratives from stock prices.

There is very much a precedent here. In 2017 it was none other than ROBO, the automation and robotics ETF of which TER is the largest component, that was ripping to new highs every day while a similar narrative about automation was rippling through markets. Despite the stock market (and speculation) surging, there was daily fear about Amazon killing everything in its path after they acquired Whole Foods in June of that year.

September 22nd, 2017: Amazon Takes Over the World

October 16th, 2017: Just Own the Damn Robots

It’s worth noting that TER went on to surge roughly 40% over three months after these articles were published. AMZN nearly doubled and didn’t finally top until August of 2018. The point is that the end of this illusion was in hailing distance.

Well, a few months into 2018 the spec trade tripped and fell on its face and ROBO fell 35% by the end of the year. This setup feels remarkably similar both in price action as well as narrative. Interestingly, TER has never had a higher RSI on a weekly basis. The odds are stacking in favor of this fading hard.

It’s unclear what exactly would actually cause a rethink but it’s not really important as usually there isn’t a single reason for a selloff, one of the main reasons they are so difficult to navigate.

Trade idea- short ROBO/TER, perhaps short NVDA. I do think this is an early call and the price divergences will likely continue which will reflexively cause more panic around software and further strenghten the narrative that automation is coming for us all but I’d say we are at most a couple months away from this trade reverting to the mean along with the narrative.

-

Thoughts as we begin 2026

Speculation, speculation everywhere

If there was one constant theme in 2025, it was the tug of war that continued between AI skeptics and the believers/opportunists. The skeptics continued to point out how AGI was nowhere near and the believers said “just wait!”

This boiled down to the question of whether this was a bubble a la the late 90’s into 2000 (seemingly everyone’s favorite analogy) or just a build up into what will eventually become a bubble a la the late 90’s into 2000. The believers consistently state this is no bubble because there are real earnings, but even if it eventually builds into one, we are in the early stages and much money will be made in the run-up.

I remain firmly in the this is most definitely a bubble camp. But, I have a more nuanced view. I don’t actually believe in the AI bubble narrative as, yes, real money is being spent on hardware and data center builds but also because the bubble (if it exists) doesn’t involve a ton of leverage and is mostly contained within the hyperscalers.

The bubble as I see it, is everywhere. To me the main difference between now and 2000 (obviously there are many as no two periods of history are exactly the same) is that speculation that would historically taken place in the stock market has bled over into so many other areas- futures, options, leveraged ETF’s, an array of sports betting apps, prediction markets, and cryptocurrencies. I’m confident that at some point in the future we will look back at this period and wonder what the hell everyone was thinking.

Distortions caused by lengthy bull markets

Madness is rare in individuals — but in groups, parties, nations, and ages it is the rule.

— Friedrich Nietzsche

Something strange happens when things go really well for a long time. You get reality distortions where otherwise, seemingly intelligent, sane people, start to believe things that are plainly untrue.

Nowhere is this madness more apparent in the false prophets that have emerged over the past several years.

There’s a new show out on Netflix called Members Only: Palm Beach. In it, a group of very wealthy middle-aged women hang out together around Palm Beach, attend lavish parties, gossip and infight. One of the recurring themes is whether newcomers to the group are prepared to hang out with the likes of “Elon and Trump.” This is a show that, if the technology allowed for it, could have been made in the midst of the 1920’s Florida real estate bubble.

My point here is that a group of socialites, far removed from Wall Street see it as the pinnacle of success to breathe the same air as Elon Musk and have raised him to single name status like Madonna or Cher. Tesla recently showed that they missed delivery estimates and in the previous year had sold 16,000 Cybertrucks, about a tenth of the projected number. SpaceX is doing some amazing things, as is Tesla and Starlink. But most of what surrounds Musk are empty promises that never really materialize. Such a cult he’s ammassed, though, that Tesla is now valued at $1.4 trillion.

This is clearly not a new story. It’s been years in the making. But now it is pretty much taken as a fact of life that Tesla is worth that much, making Musk the richest man on Earth. That creates distortions everywhere. People believe that because he has such enormous stock holdings that he must know what he’s talking about. Politicians have hitched their wagons to him. And now we can see it’s everywhere. Living in Florida, you can see Cybertrucks all over the place and Musk is viewed as a celebrity and genius of God-tier status.

It’s not just Musk. In this era there have been so many false prophets established by these distortions that I can’t list them all. Just to name a few: Alex Karp, Palmer Luckey, Andrew Dudum, Michael Saylor, Brian Armstrong. The list goes on and on and on.

This is not new, by the way. It’s actually one aspect of this period that is most definitely a parallel of the late 90’s stock bubble and long before that, John Kenneth Galbraith wrote about it in a “Short History of Finanical Euhporia.” The accumulation of wealth seems like a miracle and naturally those who have accumulated a tremendous amount are viewed to be infallable. In the late 90’s there were so many CEO’s with paper billions who would go on to lose virtually everything.

I still think you have to keep your eye on the ball. Things go crazy long enough to convince a sane person that fiction is fact because the madness becomes so normalized. But much of what is happening isn’t in equilibrium or based in reality. Most of these companies barely make any money at all. At some point valuations will matter again.

Some predictions for 26

- OpenAI adoption will increase beyond a critical mass and this will start to impact Google's search business materially

- TSLA stock will badly underperform the S&P and will experience a severe decline

- What I've termed the "Robinhood Bubble" will break and multiple stocks will experience significant declines: PLTR, HOOD, SOFI, RDDT and many more

2026

2025

2022

- A Crash Post Mortem

- What a wild week

- When the facts change...

- Going out on a limb

- No, this is not the late 90's.

- The Crash Isn't Here. Yet.

2021

- This indeed looks like a blow-off top.

- Volmageddon Part II?

- Bear Market Rallies

- Narrative Shifts

- Risk is Rising

- Market Update

- Gauging Sentiment

- Feels Euphoric Out There This Morning

- Markets are Organisms

- Finally, a Decent Setup

- Blow-Off Rallies

- Market Outlook for 2021